Wi 529 State Tax Deduction 2024

Wi 529 State Tax Deduction 2024. The legislation, passed unanimously by the wisconsin state assembly and wisconsin state senate, modified the wisconsin 529 college savings program and its two 529 college. Hyunmin kim may 30, 2024.

In 2024, for new contributions, up to a $5,000 reduction from taxable income per eligible family member per year (if wisconsin resident)** the reduction is available to anyone. Effective march 23, 2024, and applicable to tax years beginning after december 31, 2023, wisconsin increases the.

Wi 529 State Tax Deduction 2024 Images References :

Source: www.savingforcollege.com

Source: www.savingforcollege.com

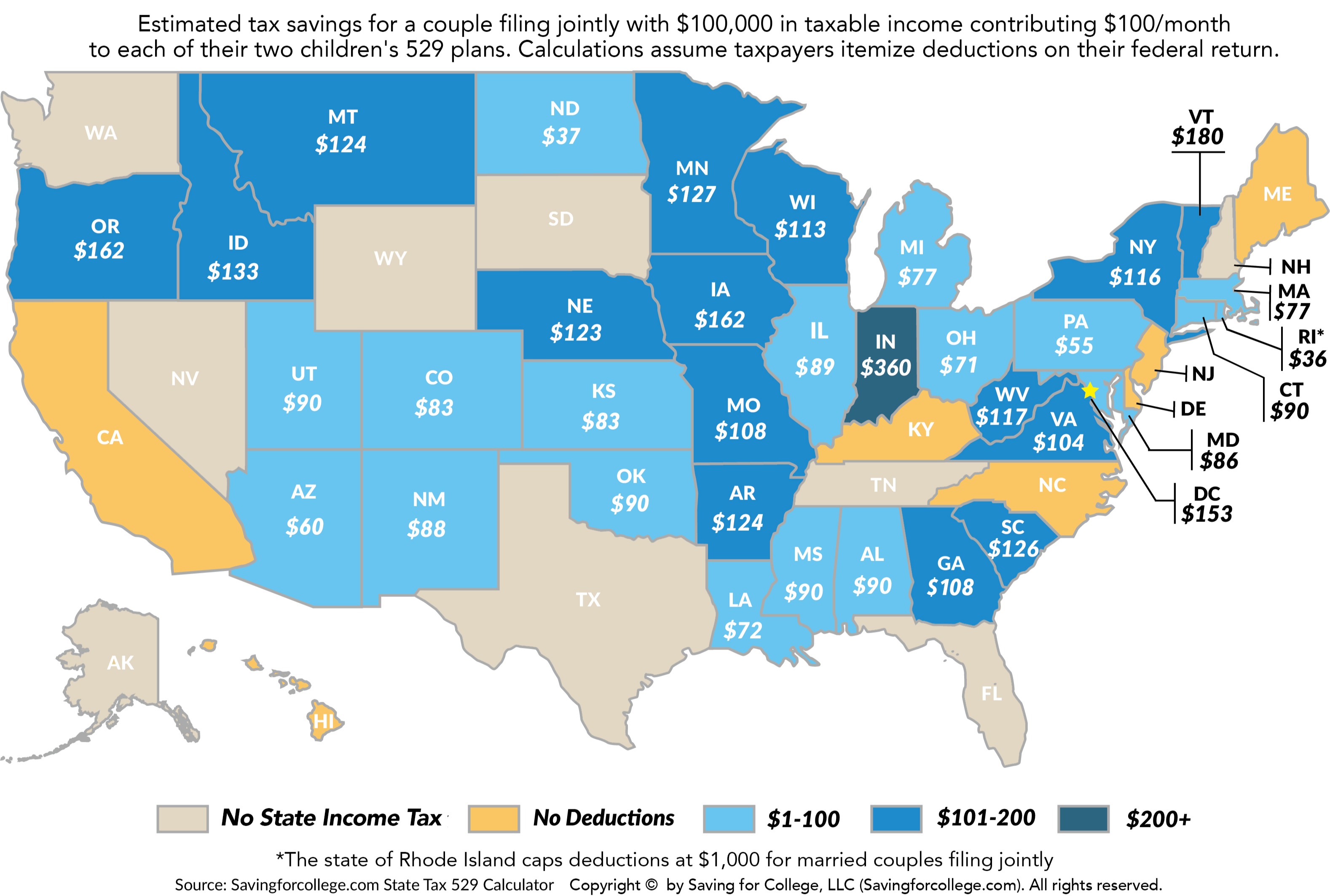

How Much Is Your State's 529 Plan Tax Deduction Really Worth?, The wisconsin state income tax deduction for contributions made to a wisconsin 529 plan is available to any wisconsin taxpayer, not just the 529 plan account owner, making gift contributions a benefit for family members or friends.

Source: oonaqsaundra.pages.dev

Source: oonaqsaundra.pages.dev

Wisconsin 2024 Tax Brackets Erika Jacinta, Wisconsin offers a state tax deduction for contributions to a 529 plan in 2024 of up to $4,000 per beneficiary ($2,000 for married filing separate status and.

Source: www.nuveen.com

Source: www.nuveen.com

Understanding state tax deductions Scholars Choice Nuveen, In 2021, wisconsin residents who contribute to a 529 plan in the state can deduct up to $3,380 from their wisconsin income tax return for each account they contribute to on.

Source: www.mymoneyblog.com

Source: www.mymoneyblog.com

529 College Savings Plans All 50 States Tax Benefit Comparison, While most states’ tax deduction rules allow families to subtract 529 contributions from their gross income, the rules vary from state to state.

Source: www.youtube.com

Source: www.youtube.com

Ask Edvest 529 Is there a Wisconsin tax deduction? YouTube, Many states offer state income tax deductions or credits for contributions to a 529 plan.

Source: rubyqjoanne.pages.dev

Source: rubyqjoanne.pages.dev

Wisconsin Standard Deduction Table 2024 Alika Beatrix, Hyunmin kim may 30, 2024.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6UOHC5JH3RC45CSBSVQI2HWXGQ.png) Source: www.morningstar.com

Source: www.morningstar.com

529 State Tax Benefits in 2024 Morningstar, Effective march 23, 2024, and applicable to tax years beginning after december 31, 2023, wisconsin increases the.

Source: www.pinterest.com

Source: www.pinterest.com

529 Plan Tax Benefits NEST 529 College Savings 529 college savings, Section 529 deduction increase (wisconsin act 148):

Source: www.heritage.org

Source: www.heritage.org

529 Accounts in the States The Heritage Foundation, Effective march 23, 2024, and applicable to tax years beginning after december 31, 2023, wisconsin increases the.

Source: www.savingforcollege.com

Source: www.savingforcollege.com

How Much Is Your State's 529 Plan Tax Deduction Really Worth?, Wisconsin offers a state tax deduction for contributions to a 529 plan in 2024 of up to $4,000 per beneficiary ($2,000 for married filing separate status and.