California Withholding Schedules For 2024

California Withholding Schedules For 2024. Generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/rdp filing separately) in tax for 2024 (after subtracting. This method will give an exact amount of tax to withhold.

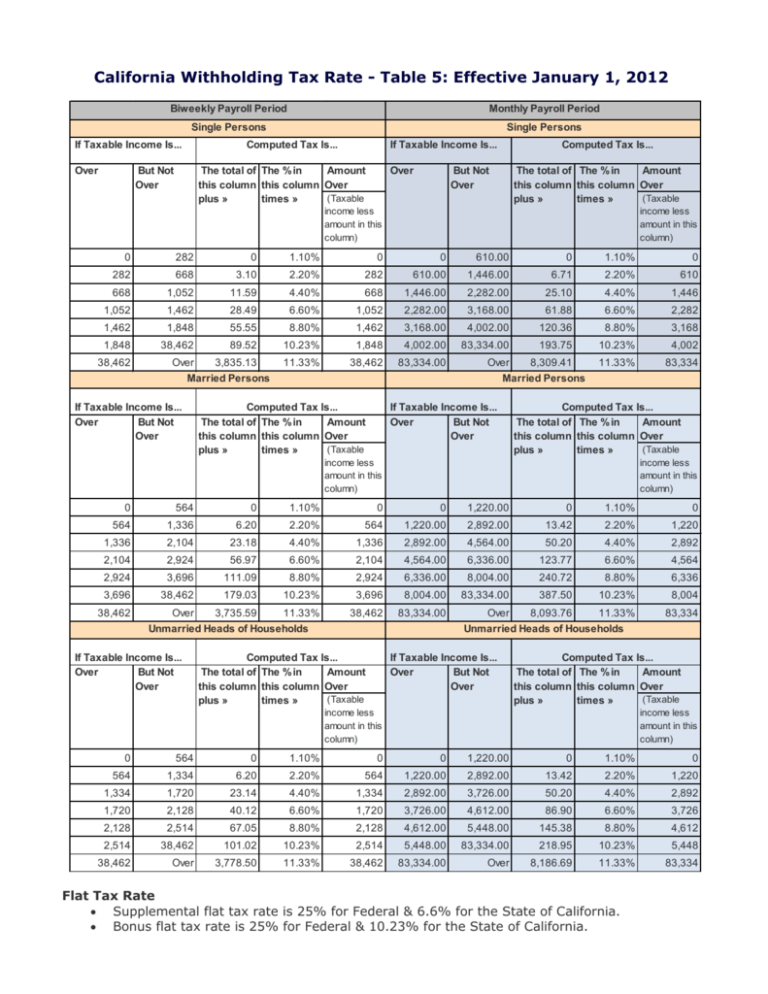

California has four state payroll. Over not over of tax ($) plus.

State Disability Insurance (Sdi) • The 2024 Sdi Withholding Rate Is 1.1.

California withholding schedules for 2024.

• The 2024 Ett Rate Is 0.1 Percent (.001) On The First $7,000 Of Each Employee’s Wages.

If the nonresident payee performs all the services within california, withholding is required on the entire payment for services unless the payee is granted a.

California Provides Two Methods For Determining The Amount Of Wages And Salaries To Be Withheld For.

2024 california state income tax tables.

Images References :

Source: rubettawannis.pages.dev

Source: rubettawannis.pages.dev

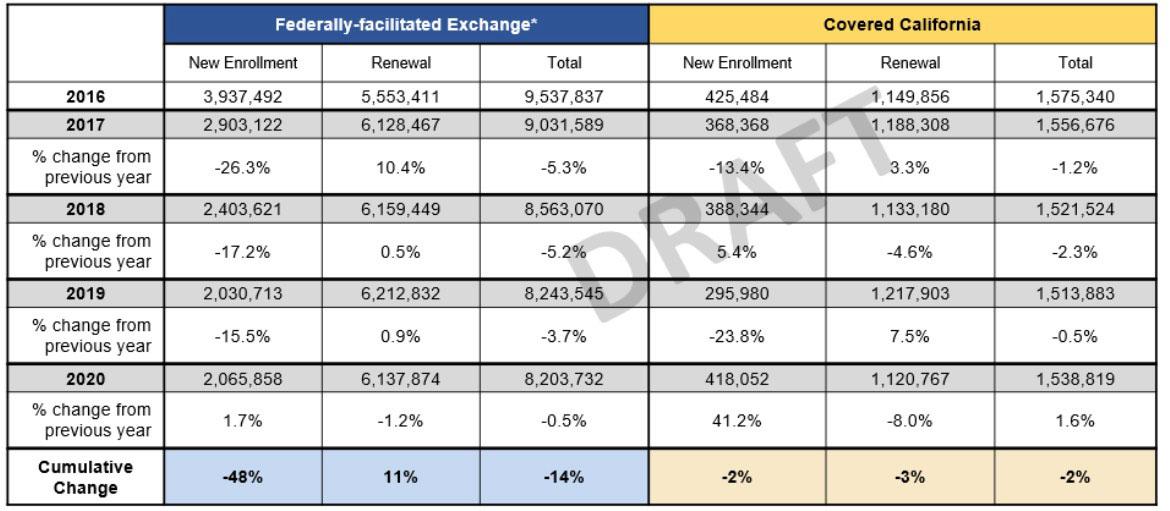

2024 California Tax Brackets Table Opal Tracee, 2024 instructions for form 592 resident and nonresident withholding statement. California provides two methods for determining the withholding amount from wages and salaries for state personal income tax.

Source: bibbieqjordan.pages.dev

Source: bibbieqjordan.pages.dev

2024 California Tax Brackets Table Maren Sadella, Generally, you must make estimated tax payments if you expect to owe at least $500 ($250 if married/rdp filing separately) in tax for 2024 (after subtracting. State disability insurance (sdi) • the 2024 sdi withholding rate is 1.1.

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, 2023 california tax rate schedules. Employee withholding amount required for remittal:

Source: schedule-list.com

Source: schedule-list.com

California Withholding Schedules For 2022, We refer to the amount of wages taken from your paycheck for state and federal income taxes as withholding. Employee withholding amount required for remittal:

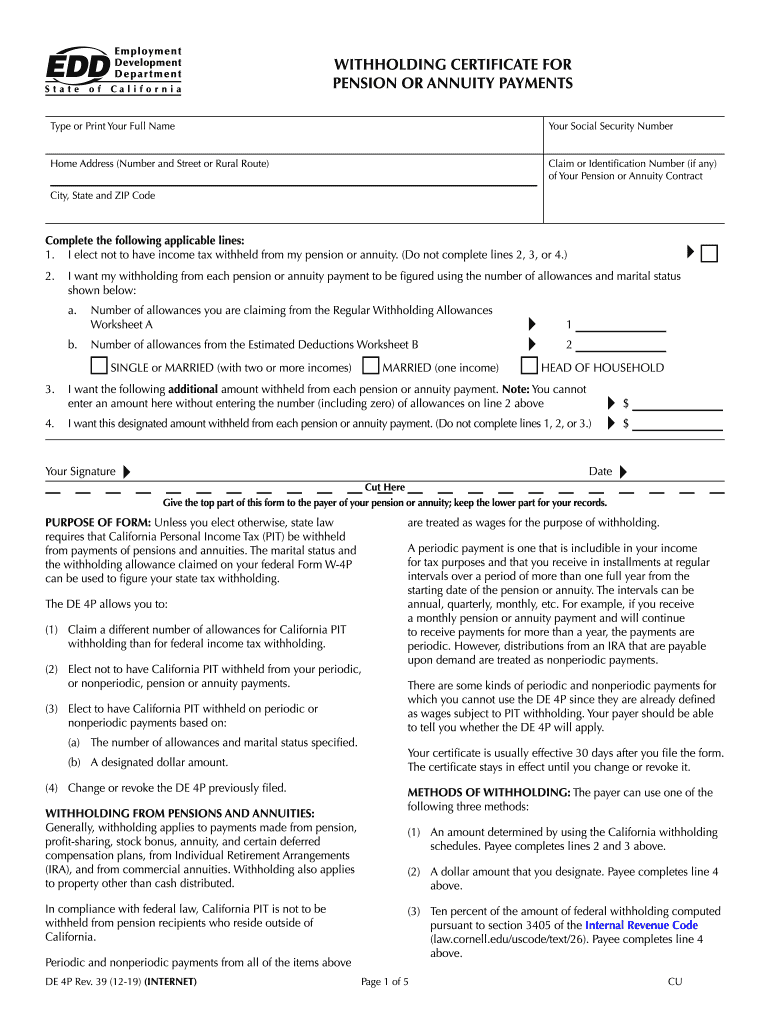

Source: www.dochub.com

Source: www.dochub.com

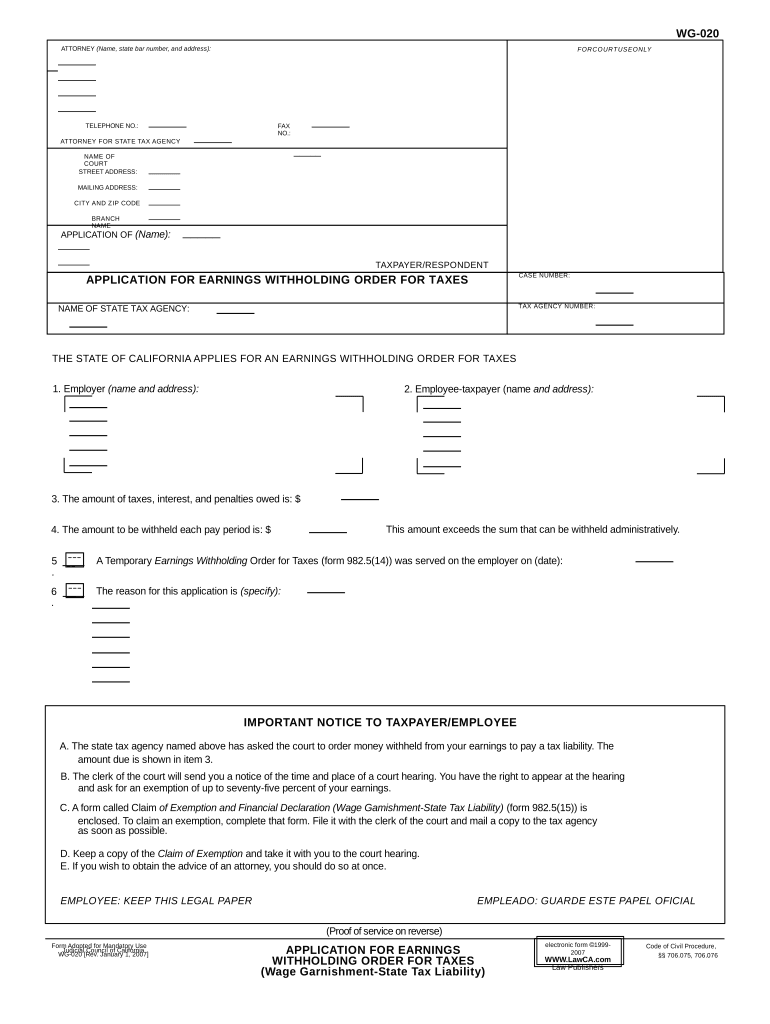

Ca state tax withholding form Fill out & sign online DocHub, Wage withholding is the prepayment of income tax. California withholding schedules for 2022.

Source: tutorsuhu.com

Source: tutorsuhu.com

Ca Withholding Tax Tables Tutor Suhu, • the 2024 ett rate is 0.1 percent (.001) on the first $7,000 of each employee’s wages. Employee withholding amount required for remittal:

Source: www.signnow.com

Source: www.signnow.com

California Withholding Form Fill Out and Sign Printable PDF Template, 2024 california tax brackets table maren sadella, california withholding schedules for 2024. 2023 california tax rate schedules.

Source: studylib.net

Source: studylib.net

California Withholding Tax Rate Table 5 Effective January 1, 2012, California withholding schedules for 2024. Over not over of tax ($) plus.

Source: brokeasshome.com

Source: brokeasshome.com

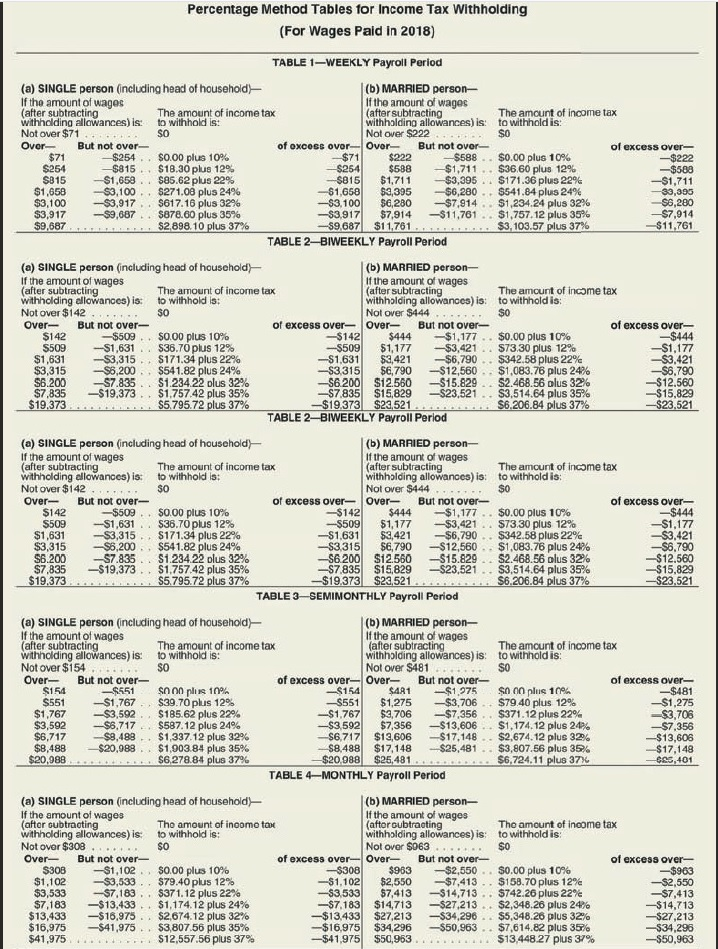

California Payroll Tax Withholding Tables 2018, California withholding schedules for 2024. Use form 587, nonresident withholding allocation worksheet, to determine if withholding is required and the amount of california.

Source: printableformsfree.com

Source: printableformsfree.com

California 2023 Withholding Form Printable Forms Free Online, • the 2024 ett rate is 0.1 percent (.001) on the first $7,000 of each employee’s wages. 2024 california tax brackets table maren sadella, california withholding schedules for 2024.

This Method Will Give An Exact Amount Of Tax To Withhold.

California’s withholding methods will be updated for 2024, an official from the state employment development department said oct.

Employee Withholding Amount Required For Remittal:

State disability insurance (sdi) • the 2024 sdi withholding rate is 1.1.

Use Form 587, Nonresident Withholding Allocation Worksheet, To Determine If Withholding Is Required And The Amount Of California.

Your tax rate and tax bracket.