2024 Fsa Limits Daycare

2024 Fsa Limits Daycare. The limits for 2023 are $ 2,500 for an individual or $ 5,000 for a family, and will remain the same for. If you pay to care for dependents while at work, use these funds to cover eligible expenses for day care, babysitting, nursery school and senior day care.

The american rescue plan act (arpa), signed into law on march 11, raises pretax contribution limits for dependent care flexible spending accounts (dc. Limits for day care flexible spending accounts are unchanged and remain at $5,000 maximum per calendar year ($2,500 if married and filing taxes separately).

Dependent Care Fsa Limits For 2024 The 2024 Dependent Care Fsa Contribution Limit Is $5,000 For “Single” Or “Married Couples Filing Jointly” Households.

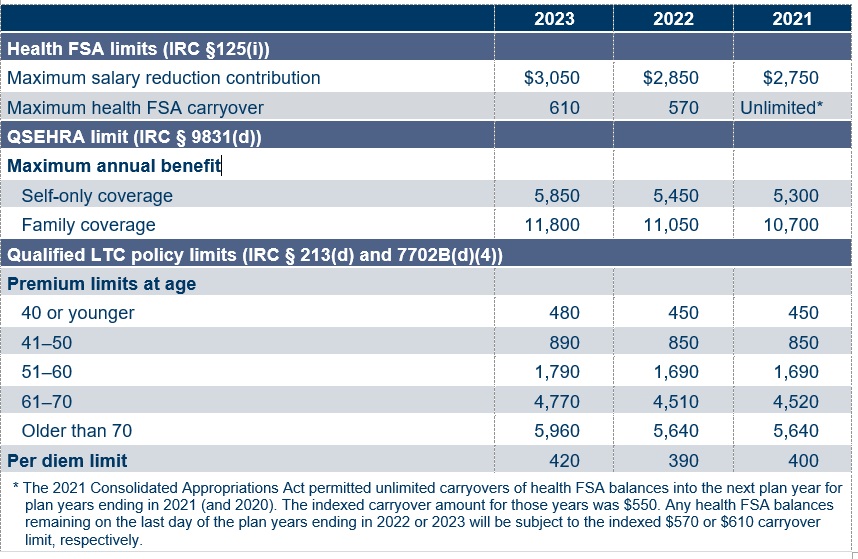

For 2024, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

The Irs Has Increased The Flexible Spending Account (Fsa) Contribution Limits For The Health Care Flexible Spending Account (Hcfsa) And The Limited Expense Health Care.

Join our short webinar to discover what kind of.

2024 Fsa Limits Daycare Images References :

Source: odessawdasha.pages.dev

Source: odessawdasha.pages.dev

Max Daycare Fsa 2024 Daisy Therese, Here’s what you need to know about new contribution limits compared to last year. You can use a dependent care fsa to cover daycare expenses for a child who’s age 12 or younger.

Source: fayinaqnancee.pages.dev

Source: fayinaqnancee.pages.dev

Fsa Daycare Limits 2024 Elaina Stafani, Here, a primer on how fsas work. On november 9, 2023, the irs released the 2024 health fsa / limited purpose fsa and commuter benefits maximum contribution limits.

Source: clairbcamellia.pages.dev

Source: clairbcamellia.pages.dev

2024 Fsa Limits Daycare Rita Verina, Limits for day care flexible spending accounts are unchanged and remain at $5,000 maximum per calendar year ($2,500 if married and filing taxes separately). Here’s what you need to know about new contribution limits compared to last year.

Source: sallyannewthea.pages.dev

Source: sallyannewthea.pages.dev

2024 Fsa Rollover Amount Lory Silvia, Irs increases fsa limits for 2024. What is the dependent care fsa limit for 2024.

Source: wilienadean.pages.dev

Source: wilienadean.pages.dev

Will Fsa Limits Increase In 2024 Lynn Sondra, The limits for 2023 are $ 2,500 for an individual or $ 5,000 for a family, and will remain the same for. You can contribute up to $5,000 in 2024 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent.

Source: philipawgerrie.pages.dev

Source: philipawgerrie.pages.dev

Fsa Limits 2024 Dependent Care Tera Abagail, A dcfsa covers expenses for child daycare, nursery school, adult daycare and similar expenses for eligible children or adults who can't care for themselves. What is the 2024 dependent care fsa contribution limit?

Source: chereqmillicent.pages.dev

Source: chereqmillicent.pages.dev

Hsa Limits 2024 Calculator For Over Ronny Cinnamon, For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610. Join our short webinar to discover what kind of.

Source: valerywanthe.pages.dev

Source: valerywanthe.pages.dev

Fsa Limit 2024 Uta Zorana, The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2024. For unused amounts in 2023, the maximum amount that can be carried over to 2024 is $610.

Source: verlaqkarola.pages.dev

Source: verlaqkarola.pages.dev

2024 Fsa Limits Perla Kristien, For example, an employee could use fsa funds for childcare expenses during their own working hours, but not for date night. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care.

Source: kateeqrosalie.pages.dev

Source: kateeqrosalie.pages.dev

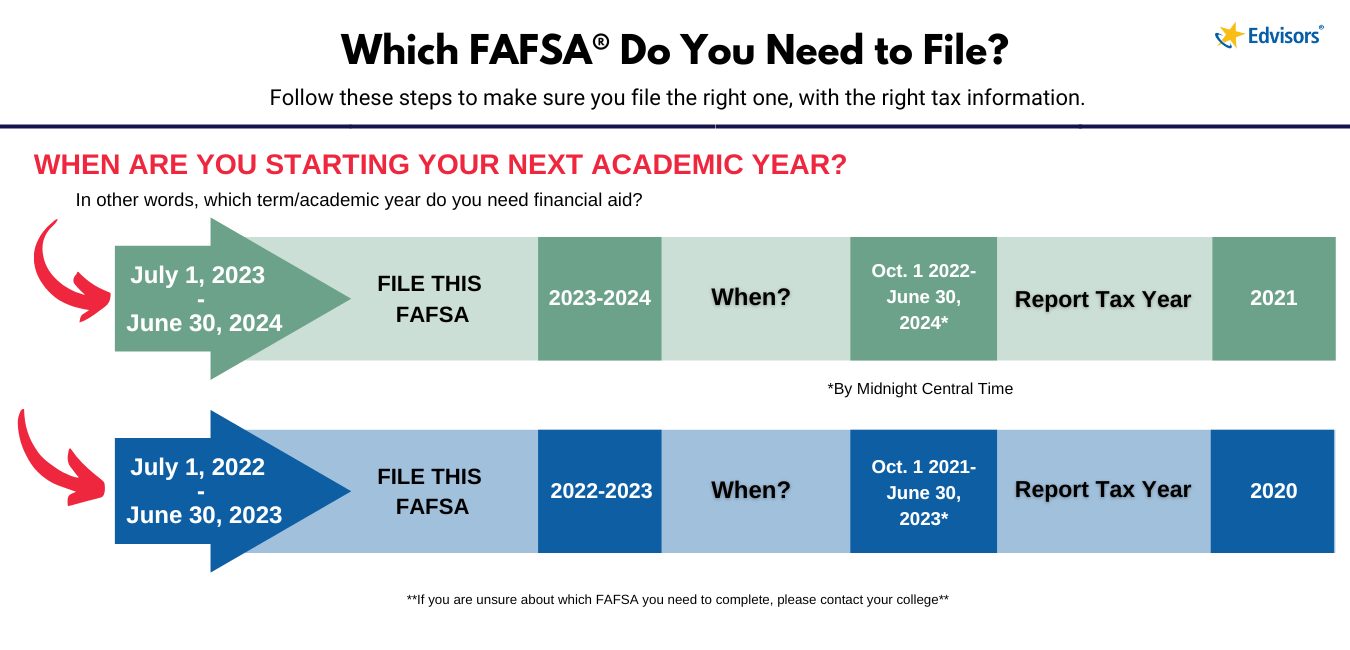

Fafsa 202424 Application Cheryl Thomasina, The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in. There are no changes to dependent.

There Are No Changes To Dependent.

It's important for taxpayers to annually review their health care selections during health care open enrollment season and maximize their savings.

The Latest Mandated Fsa Employee Contribution Limits On How Much Employees Can Contribute To These Accounts Is Shown In.

The irs released 2024 contribution limits for medical flexible.

Category: 2024